If you follow us on social media, you may have noticed that last week we launched our company re-brand.

As part of the re-brand process, we took a lot of pictures and made a lot of videos for social media.

If you watched any of our videos, it will be easy for you to see how uncomfortable I am with all this social media stuff.

Totally outside my comfort zone!

If you ever want a good laugh, ask Nicole or Garett to send you some of the many takes of me totally screwing up my words…

@Nicole @Garret — never send those clips!

The picture above is one that I was very happy to take and post.

This is a pic of myself and John, our Principal Broker, and former President of UCC.

Even though he is trying to slow down and retire, John remains very important part of the team.

I very much value having him by my side. His experience and knowledge are priceless.

I don’t think John reads these newsletters, but if he does, he’s going to kill me for including him in it, lol.

For 50 years we have been known to the public as Unimor Capital Corporation.

Going forward, we are now UCC Mortgage Co.

Along with the name change comes a new logo and new colours.

On the topic of change… I foresee a lot of change when it comes to the way Canadians think about their housing situation, in the future.

For as long as I’ve been alive… for the most part, if a Canadian aspired to live in a house, they could. Some would buy, some would rent, but either way… a house with a yard was usually an option.

Not so sure that’s going to be the case in the future…

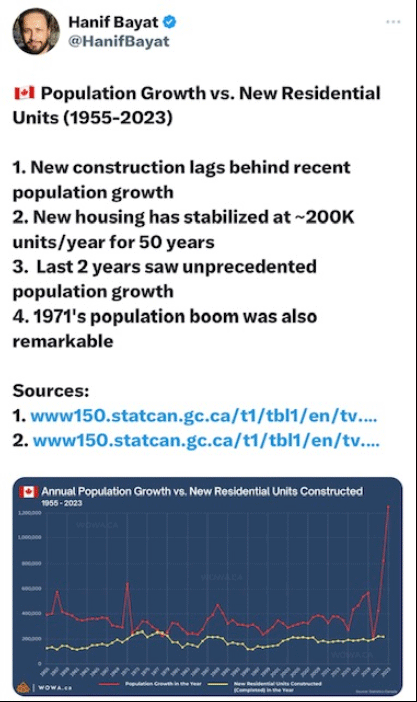

Check out this chart:

The red line represents population growth, while the yellow line represents new housing units.

Essentially, the pace at which we’ve been creating new housing has not kept up with how quickly the population has been growing.

This has been going on for quite some time, but things really got out of whack beginning in 2020, fueled by increased immigration.

CMHC, Canada’s national housing agency, even came out and said that “almost $3.5 million new units will have to be built by the end of the decade.”

To be fair, the private sector screaming about this for years, it’s just within the last 12 months or so, that all levels of government finally came to terms with this reality.

So put this into perspective for a second… CMHC says we require $3.5 million new units by 2030, yet historically, on average, we only build 200k units per year.

Even if we were to somehow double out historical output to 400k units per year for the next six years, we would still fall short by 1.1 million units (400 units x 6 years = 2,400 units).

A keyword used by CMHC is UNITS, not HOUSES.

And you better believe they pick and choose their words carefully when putting out these statements.

I strongly believe that going forward, most new residential development will be in the form of multi-unit buildings.

More specifically, high-rise buildings.

Build UP instead of OUT… it’s really the only efficient way to address the housing shortage that has so quickly gotten out of hand.

To localize it for you, our office is currently working on some financing for a development in the Town of LaSalle, in the Laurier Parkway area.

They’re at the final stage of rezoning, and once finalized, there will be the ability to basically double the population of LaSalle, just in that area.

They’re accomplishing that by allowing for high rise residential buildings, up to 12 storeys high.

There will be very few single-family homes in this development.

And I foresee this trend being adopted by most municipalities across the province.

Which means over time, more and more people will live in multi-family buildings, instead of single family homes.

And I’m not suggesting this is a bad thing… just very different from what we’ve been accustomed to here in Canada.

And what that does this trend do for the value of a single-family home?

My belief is that they become even more valuable and less affordable over time.

Until next time,

Vince